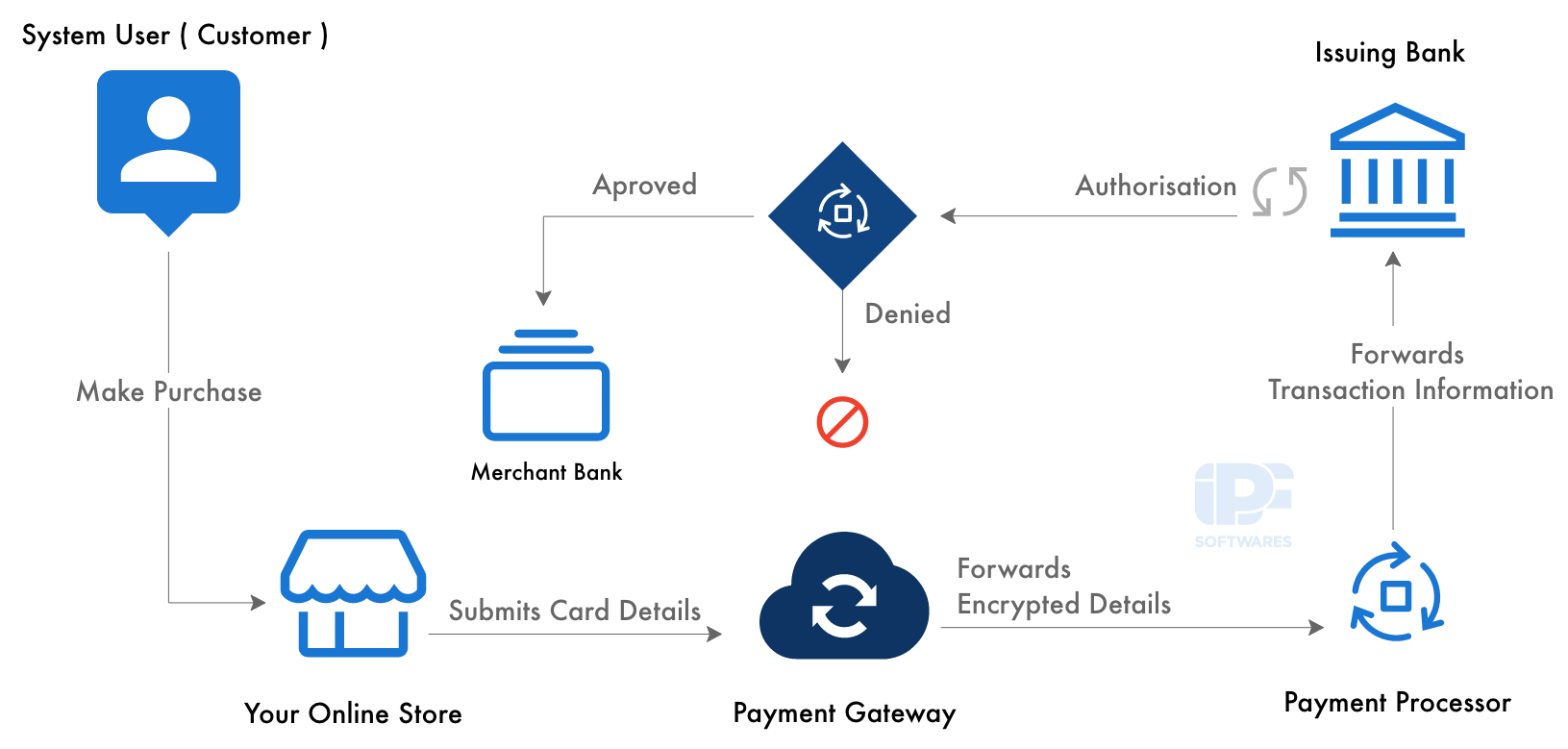

A PSP (Payment Service Provider) will provide a full service that includes both technical payment processing and money collection on behalf of the merchant; this is likely the quickest way for you to begin collecting payments while avoiding the need to open merchant accounts with each financial institution i.e Banks, Card Providers, and Mobile Network providers (MNOs).

A payment service provider simply establishes a new sub-account under one major merchant account, aggregating all the other sub-merchants, when onboarding a new merchant.

Because Payment Service Providers aggregate all transactions from hundreds or thousands of different merchants under one account, they are commonly referred to as payment aggregators

Most Payment Service Providers provide their own payment gateway and APIs to connect and access their services;

Despite providing an out-of-the-box payment solution, it is required for a software developer to develop and integrate your digital solution and PSP’s API in order to start collecting payments through your mobile or website application.

Are you looking to integrate your digital solution with any of Africa’s payment service providers? Contact us for technical guidance and support. At iPF Softwares, we have helped our clients and partners in integrating and collecting payments with over 7 Payment Service Providers and Financial Services; learn more how we deliver AI Powered Software Development Services

PAYMENT SERVICE PROVIDER CASE STUDY

The easiest way to start collecting online payment would be to directly connect with the payment institutions or mobile money providers (MNOs), however the process for opening a merchant account and integrate with each of the financial institutions and mobile money service providers it can be hectic so many red tape and validations you have to go through and onboarding shenanigans.

And this is where Payment Service Providers (PSPs) come into play; they have gone through the chaos so you don’t have to knock on doors to every each financial institution you wish to integrate with;

Instead of having 3 to 4 merchant accounts with Tigo Pesa, MPesa, Halotel, Airtel, Visa, Master Card, and others; Your business may accept credit and debit cards, mobile money payments, and bank transfers with a single connection to your Payment Service Provider of choice, i.e Selcom, Direct Pay, Azam Pay, Fast Hub, Beam Africa, and others.

Later on, We’ll go into the advantages and disadvantages of integrating with Payment Service Providers vs Financial Institutions directly.